“I think it’s a beautiful thing,” says Darby MacDowall over the hiss of steam and the whir of grinders at Northern Light Espresso Bar and Cafe in downtown Scranton. This isn’t the expected response from a businessman, not even one in a blue cafe manager’s apron, to a new state tax law, but Act 32, which took effect Jan. 1, seems a little different.

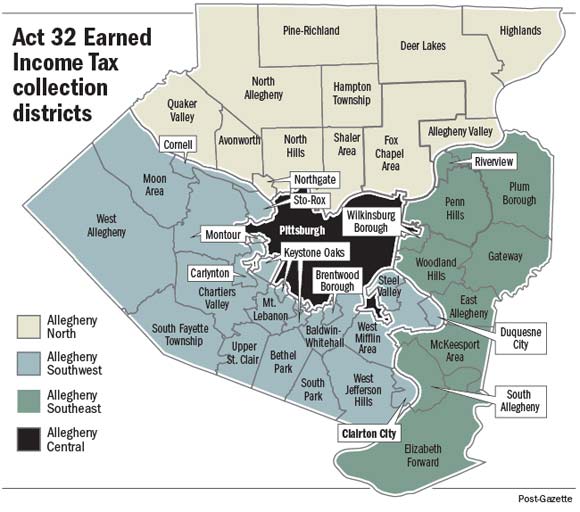

The law consolidates the current 560 entities that collect local earned income taxes into 69 tax collection districts, one per county except for four in Allegheny County. Those new collection districts, in turn, will electronically transfer the appropriate share of revenues to the nearly 3,000 school districts and municipalities that levy the taxes. Businesses such as MacDowall’s are expected to benefit, but they first have to understand the new law and comply with it.

By consolidating tax collection, Act 32 does a few other things. First, it requires any company with a “work site” in Pennsylvania to collect Residency Certification Forms from its employees. (A work site includes any employee who works from home in Pennsylvania no matter the location of the employer.) Employers then have to withhold local earned income taxes for their employees at the higher of two rates: the rate where the employee resides or the rate where the employee works (except in Philadelphia, which has its own rules that supersede ct 32). Self-employed individuals file quarterly estimated earned income tax returns with the local tax collection district.

Finally comes the simplification: instead of paying those local income taxes to all the various municipalities and school districts that encompass their workforce, employers can send all the taxes to a single tax collection district that then divvies up the payments for them. Large retailers with multiple worksites, such as Wal Mart or Sheetz, particularly benefit because they can pay all their taxes in one place instead of dozens or more, so long as they give advance notice to do so and follow other guidelines. Act 32 also standardizes forms and procedures, further simplifying tax collection and administration. And if you find the processes regarding tax filing and penalties confusing, approach a service provider like Federal Tax Resolution. In case of failure to pay a penalty, similar tax resolution services penalty abatement can guide you on how to proceed after accessing your case.

For someone such as MacDowall, Act 32 “changes nothing. As for as accounting goes, we write the check to a different person,” he explains, and he imagines the computerized forms are simpler for the tax collectors. MacDowall admits, however, he has somewhat of a reputation for being especially organized and on top of things, including Act 32.

A Scranton-based company that handles payrolls for small local businesses as well as large national corporations in Pennsylvania and New Jersey, We Pay Payroll Processing Company also appears on top of Act 32. We Pay’s Jaclyn Bennett says they’re prepared for the transition, which should ultimately simplify tax payments. “As a payroll company, we keep up on those things. We educate our clients as well. Our software is pretty adaptable and well set up for these things.”

Questions Remain, Answers Coming Quickly

But not all business owners are as ready. Down the street from Northern Light, Kathie Fox runs The Fanciful Fox Soap and Candle Company, where she and her daughter make and sell hand-crafted, vegan bath and body products. When asked about Act 32, she says, “I’m sorry to say I don’t really know what that is. It’s only really my daughter and I here together, so we don’t have lots of employees. I’d have to talk to my accountant.”

She’s hardly alone. “Seventy-five to eighty percent of the calls coming in to DCED are about Act 32 right now,” acknowledges the Department of Community and Economic Development’s Sean Sanderson, the state’s point man for Act 32. “No doubt about it, it’s crunch time.” Companies are still slightly confused or just now ramping up for the implementation of Act 32 after three years of outreach by the DCED, working with Chamber of Commerce, Department of Revenue, and others.

Of course, some of the details of Act 32 implementation emerged sooner than others. For instance, certain forms had to be created first and new tax collectors elected. The pieces, nonetheless, have come together and DCED has posted online the official register of new tax collectors, their contact information, and tax rates.

Once in force, Act 32 shouldn’t just simplify tax payment: it should improve compliance. Studies estimated hundreds of millions in local taxes went uncollected because employers, especially those outside Pennsylvania, did not know they had to withhold the local earned income tax and employees did not realize they still had to pay it. Sanderson notes, “A number of employers we’ve spoken with have never withheld the tax before. They could fly under the radar; the responsibility was on them to collect the tax, but they just didn’t get it done.” Now, with the simpler system, they should.

MARK MEIER is a writer, independent consultant, and part-time professor who lives in Dunmore and plants butterfly gardens in Scranton (which is his back yard). Send feedback here.

PHOTOS:

Mother and daughter team Amber and Kathie Fox of Fanciful Fox in Scranton.

Map showing Act 32 tax districts.

Homemade, Organic, Vegan, Fairtrade bath fizzies made at Fanciful Fox.

Kathie Fox adds coconut oil to palm oil while mixing a batch of soap.

Amber Fox restocks candles.

Amber hand-packages homemade candle.

All photographs (except map) by AIMEE DILGER