Wayne Barz has managed Ben Franklin TechVentures, an award-winning business incubator in Bethlehem, for more than 15 years. TechVentures is owned and operated by the Ben Franklin Technology Partners of Northeastern Pennsylvania. He previously managed the Bridgeworks Enterprise Center, an Allentown-based business incubator and member of the Ben Franklin Business Incubator Network. In the Keystone Edge series, “Lessons from Incubating Innovation,” Barz shares the many lessons he has learned over his two decades in the industry.

Let this be a warning to all the entrepreneurs out there: We are not falling for your TAM SAM flim flam scams any more. Seed- and early-stage investors will no longer tolerate the market-sizing shenanigans that many entrepreneurs learned from MBA classes or some expert’s book.

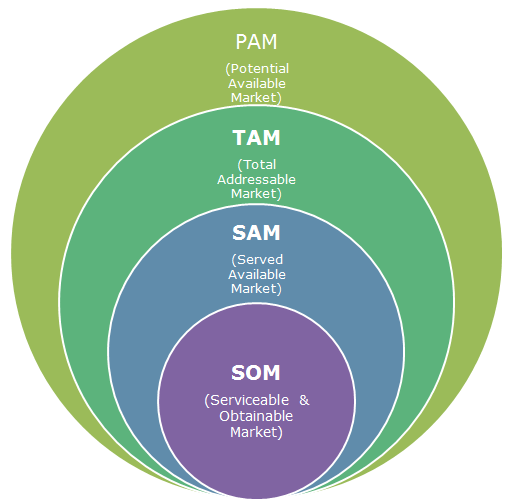

This graphic will be familiar to many who give or receive investment pitches. Generally speaking, the framework is used to depict the size of a company’s target market. The concept begins with a wide-lens and usually global view of the potential market for a product and suggests ever-narrower market-size quantifications. It’s often used to ‘wow’ an audience with an audaciously large potential number before getting down to a more sensible, but probably still unrealistic market prediction.

As a seed-stage investor, I tend to ignore it completely since it really provides insufficient context about the competitive landscape that the startup is actually going to encounter. Let’s go through an example.

An entrepreneur with a new point-of-care test for Lyme disease might use this framework and show a slide or two describing the market this way:

PAM – Potential Available Market – The global Point-of-Care Testing market is $10.5 billion.

TAM – Total Available Market – The U.S. market for Point-of-Care Testing is approximately $6 billion.

SAM – Served Available Market – Lyme disease treatment generates $1.5 billion each year in the U.S. alone.

SOM – Serviceable Obtainable Market – Testing for Lyme disease is about half of the treatment market, or $750 million.

As with many flim flams, there is a lot of misdirection in this information. First of all, no investor I know talks in terms of these definitions. In fact, as I discovered doing research for this post, the acronyms themselves are not universally used. Sometimes the “A” is “addressable” and sometimes it’s “available.” And without a 10-minute academic discussion, what’s the difference?

Also note that in the example, the actual qualitative description of the market changes from the PAM/TAM of “Point-of-Care Testing” to “Lyme disease.” I understand that we’re winnowing down to what really matters, but why start with the irrelevant parts of the market in the first place? Finally, even when we really start to get to the heart of the market quantification that matters — the SAM and SOM in this case — the entrepreneur ignores the fact that the $750 million “Lyme disease testing market” probably includes lots of other products and services beyond the narrow product that this particular company will sell.

But the absolute worst part of this type of analysis is what comes on the next slide. It’s there that the entrepreneur’s TAM SAM flim flam scam reaches its denouement! The founder drops a line like, “So you see, by capturing just 1 percent of the market by year three, we’ll be generating $7.5 million in revenue.” Wise investors will now know that this founder has revealed himself as a market-sizing fraud!

There are several better ways to construct the market quantification story of your new venture. The most important of these is to start from the bottom and not from the top. Answer the following questions:

- What type of entity or entities would buy your product (i.e. Lyme Test in this case)? Would it be hospitals? Individual physicians? End users? If the answer is “all of these,” the market-sizing scam may be in play!

- How many of each type of entity exists? The “addressable” aspect of your market quantification description will change over time as your organization expands and its geographic reach grows. For example, your initial “addressable” market for a test like this may only be “family physicians in a three-state region.” An app in the Apple Store may appear to have an immediate global reach, but how much is truly addressable through marketing efforts and customer support? The number you should be quantifying here is the number of customers, not the percentage of market capture.

- What do you plan to charge for your particular product? In our example here, the $750 million represents a total of about $2,500 to $3,000 for each of the approximately 300,000 people with Lyme disease in the U.S. If your test will only cost $100, getting to your $7.5 million in three years actually represents 25 percent of the market — a much bigger challenge!

- Finally, include some evidence that you’ve actually spoken to some individuals from item no. 1. Bring some primary market information to your presentation and not just some wild, top-down market analysis from huge research firms like Frost and Sullivan or Deloitte. If you’re Johnson & Johnson and you tell me that you’re going to attack all aspects of the $750 million Lyme disease testing market, I might believe you. But as a startup with one product idea and no or limited sales to date, start at the bottom.

Once you have a better handle on exactly who your customer is, then you can tell me how many of them exist, multiply that number by how much they’d pay and how frequently, and then you’ll have a solid quantification of the addressable market. The percentage of a market captured should be the result of the exercise, not the starting point.

I know that most entrepreneurs aren’t trying to bamboozle us with complex market sizing scams. There are times when founders appropriately use the PAM/TAM/SAM/SOM methodology or some variation of it during discussion of their market, but it’s best used when plotting the longterm vision for a company. If we’re talking about the next 12 months of your startup, let’s be more straightforward and look bottom-up instead of top-down.

Wayne Barz, Manager of Entrepreneurial Services for the Ben Franklin Technology Partners of Northeastern Pennsylvania, can be followed @TechonomicMan on Twitter and on the web at TechonomicMan.com.